Understanding the US Government Simply

Stuff

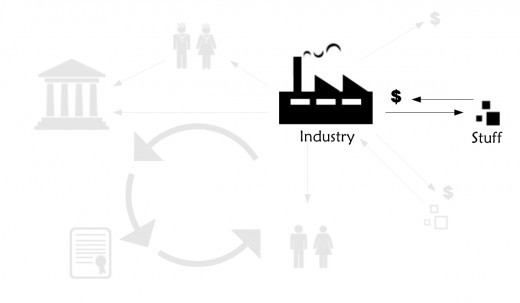

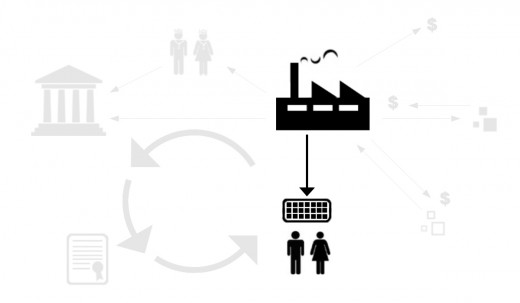

Central to economic activity are businesses and industry who sell stuff, and in so doing make money (hopefully).

Industry

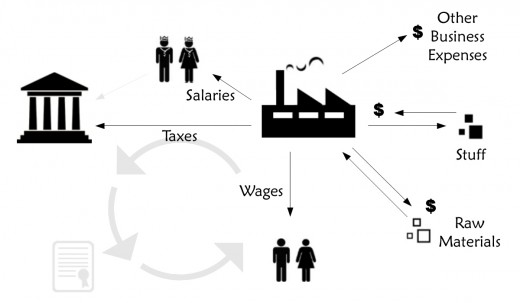

With that money businesses do a number of things; pay wages, buy raw materials, pay other business expenses and pay taxes.

I have made a distinction between compensation being paid to the wealthy (calling them salaries), and compensation being paid to the poor and middle class (calling them wages). I know the reality does not break down that neatly, I am doing it for simplicity's sake.

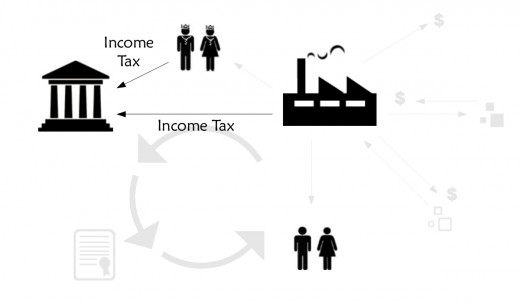

Taxes

The federal government gets half of its money from individual and corporate income taxes.1 Income tax paid by individuals comes disproportionately from wealthy individuals. Close to half of taxpayers don't pay any income tax at all, which is why in the picture below no income taxes are shown being sent to the government by the poor individuals.

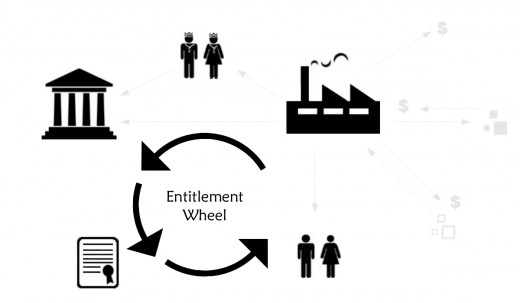

Entitlements

A large chunk of federal spending goes towards entitlement programs - welfare, Medicare, and Medicaid - all programs which primarily benefit low-income people. The entitlement programs are like a giant wheel, which take a pile of money from one place (the wealthy and businesses) and turn it through a variety of government agencies to another place (the poor and elderly).

So, Does this make Sense?

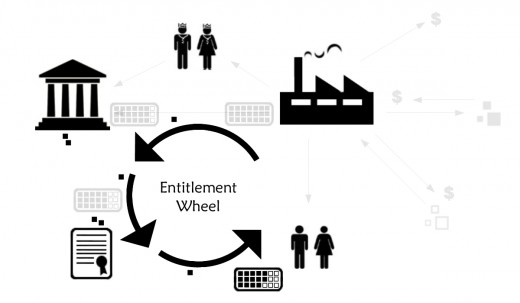

No, not really. Regardless of one's ideological or philosophical position, it is inefficient and wasteful to move money through the great wheel. Every step of the way incurs costs and efficiency losses. It's like running a 500 foot hose around your house to water some plants that are 10 feet away. The diagram below is an illustration of the money truck driving around the entitlement circle dropping bundles of money out the back as it goes

Are the losses really as great as the graphic suggests? Probably not. Or at least, not on paper. It is hard, however, to quantify all of the losses. Some losses can only be measured by comparisons to alternatives. What would you do with the money spent on you through entitlement programs if it was in your pocket instead?

Why do we do it?

I suspect there are two reasons. First, is that many likely see it as a necessary counterbalance to the Republican agenda (an agenda which is not entirely their own). If Republicans work to put money in the hands of businesses and the wealthy, then Democrats have to work to redistribute that wealth back to the poor and middle class.

Secondly, and Democrats may not want to admit it, but being responsible for a very large stream of money flowing into the hands of very large groups of people provides tremendous political advantage.

Am I actually agreeing with Republicans?

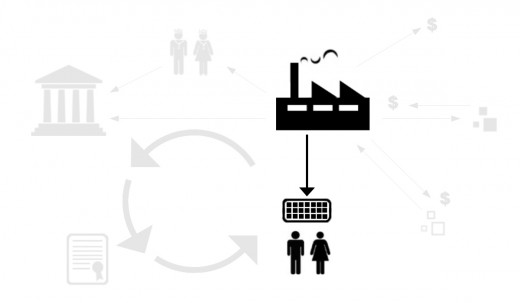

Sort of. Half agreeing I guess. We agree in wanting to shrink entitlement programs but we do so for entirely different reasons. For my part, I do not disagree with working for a more economically equal society, I just think the entitlement program is an inefficient way to do so. Instead of sending the huge pile of money on its great wasteful journey, send it directly to the people (you know, the shortest distance between two points being a straight line).

Ya, that's what I'm talking about. See how nice that looks and how stupendously simple it is. We will get back to that in a bit.

Republicans on the other hand aren't really interested in a more equal society; they just want to turn back entitlement programs. This is how they want things to look:

Republicans

Republicans will give all sorts of reasons for doing this; Limiting the size of government, combating spending (and the rising deficit), ideological quandaries with income redistribution, and entitlement programs being unsustainable.

Republicans will make all of these points sound really good. The great genius of Republicans over the past few decades is their tremendous ability to convince ordinary folks that they are working for them. Reagan of course was the master of this, which I think is largely why he is so revered. His trickle down economics has to be one of the great scams of all time, and essentially amounted to saying, "the best place for your money is in my pocket". Brilliant!

It is important I think to keep things simple when evaluating politicians. There are two things I think you should always try to know about a politician: To find out exactly what a politician is going to do for you and to follow the money. Following the money is a subject for a whole other article, but the other part is really important. A politician should be able to look at you and very specifically tell you exactly how they can help you. and if they can't, then I would argue that they aren't really working for you.

When you scrape off the rhetoric there really are only two things the Republicans ever say; cut taxes and cut spending. Of course when they say those things, they don't mean cut all spending and taxes, they mean cut entitlement spending and cut taxes for the wealthy and for businesses. Neither of these things do any direct good for ordinary folks. These measures will always be presented with theoretical benefits for common people, but they are always shadowy possibilities around the corner, or existential doomsday scenarios; deficits bankrupting our grand-kids, evil socialist takeovers (not that anyone has any idea what socialism is), or Obamacare death panels killing granny.

Compare that to what republicans say to the wealthy and to businesses. We want to cut regulations. We want to reduce your taxes. Very clear and very direct.

The answer

We all know the answer. We all felt the answer in the rage people had when fat-cat wall street pimps laughed their way to the bank with their giant bonuses bulging in their pockets.

Yes, rich pimp guy, I know you do, but then I have some news for you - we ALL work hard for our money.

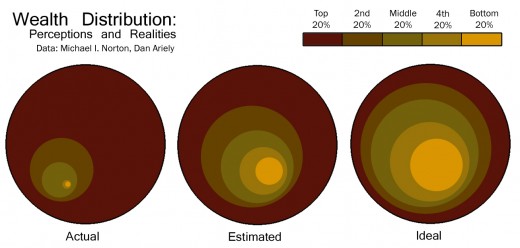

Wealth Distribution

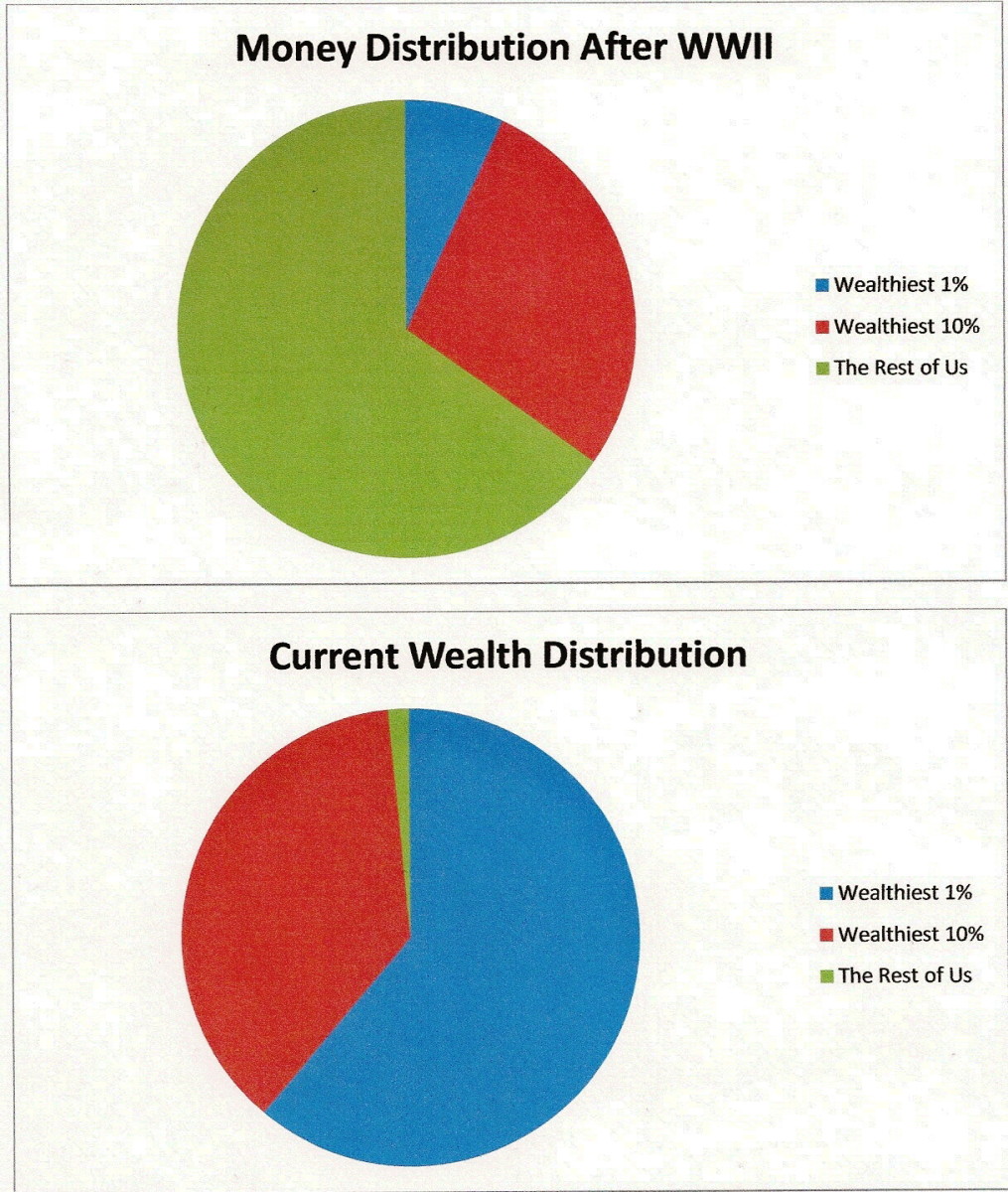

Researchers Michael I. Norton and Dan Ariely have conducted a survey to examine American perceptions about wealth distribution2. Respondents were asked what they believed wealth distribution was and what they thought the ideal wealth distribution should be. They then compared these results to what wealth distribution actually is. Their findings are summarized in the graph below.

The actual wealth owned by the bottom 20% of the population is 0.1%. That's 0.1% not 1% - equivalent to one dime out of every hundred dollars owned.

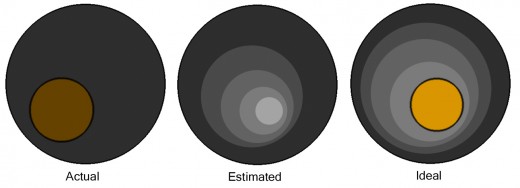

It is astounding how far off people's perceptions are, both in how they perceive distribution, and again in what they ideally would want distribution to be. To look at it another way, let's consider two particular circles. The actual 2nd 20% circle and the ideal bottom 20% circle highlighted below.

The actual 2nd 20% circle represents the wealth owned by the bottom 80% of the population, while the ideal bottom 20% circle represents how much wealth people believe the bottom 20% of the population should own. They are almost the same!

How in the world can our country look so massively different from what we want it to be. It is absolutely stunning to me. Americans are suffering from a mass Power Word Stupid spell and we had better soon wake up.

Dad

When I was a kid, my Dad stocked shelves at a grocery store. He had been there awhile and so his pay was higher than what someone would make starting out, but his longevity in itself is different from how things are today. My mom stayed home with my sister and me. We were a long way from rich but we were also a long way from being poor. We had a house, a car, food, clothes and health insurance, with enough extra to go on small vacations and to have nice christmases. You can't do that anymore - not with a low skill manual labor job - probably not even with a high skill manual labor job - maybe not with 2 of those jobs.

This isn't just my story - this is most of our stories. We don't get as much for the same amount of work that we used to. We all know this to be true. We know it in our realities and we know it in our guts. Have we gotten lazy, less skilled, less educated, less productive, less creative? No, we have just had a decades long assault on our compensation through stagnant wages, outsourcing, stripping benefits, beating down unions, and the poor state of our educational system.

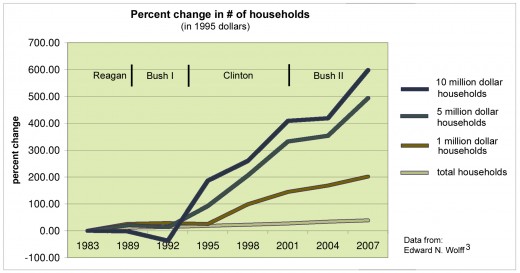

But, it has to be that way.

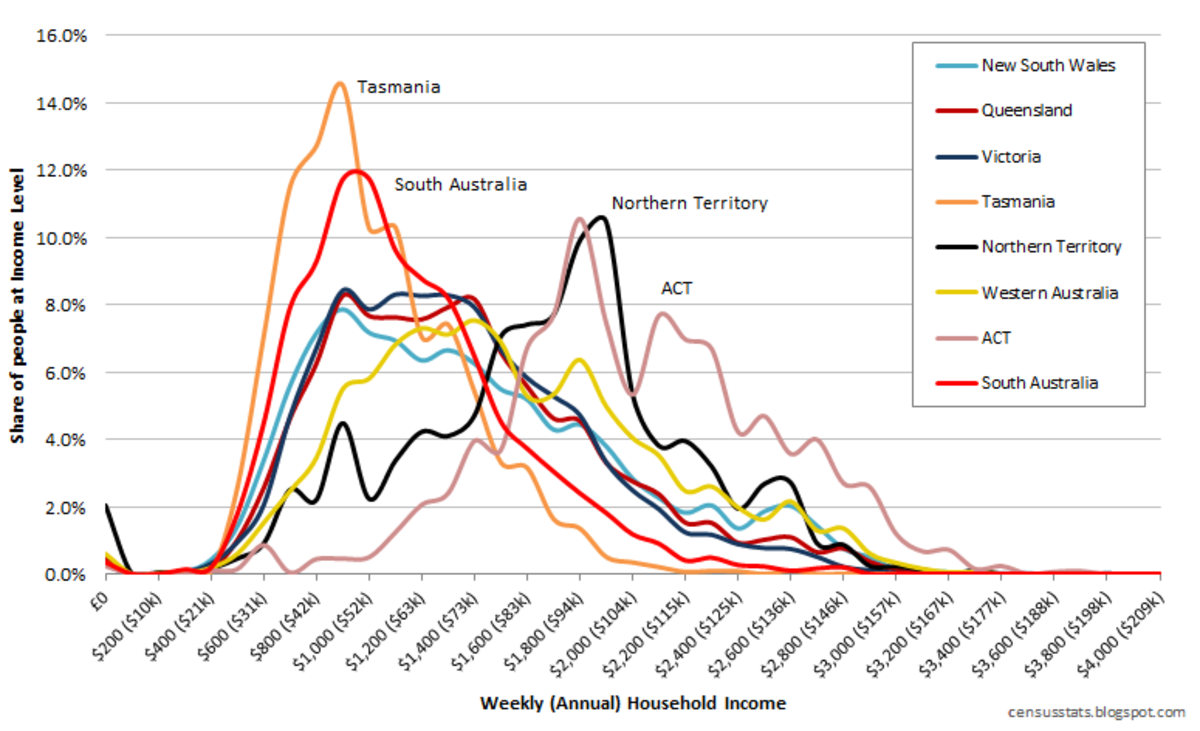

Due to globalization, and low cost labor in other parts of the world, it is necessary for American labor costs to be reduced so American companies can remain competitive. Right? I mean, that's the argument isn't it? But then, aren't high wages and CEO pay as much a cost of business as labor costs? Why is it that low wage employees are the only ones who have had to make the sacrifice? Have American corporations been losing money, have CEOs and other high-wage earners been losing money or income? No, they are all doing just fine. In fact they're doing better than fine. There are all sorts of statistics that show how well the wealthy are doing. There's no need to go over all of them. This one in particular, I think is pretty good - it shows percent change in households of certain wealth levels.

Capitalism

There is no morality in Capitalism. Pure capitalism is essentially a king of the mountain death match. We add morality to it because we dislike the idea of death matches. So, we have things like safety nets (welfare, unemployment, bankruptcy, etc), so that when people get tossed from the mountain (which we accept as being alright) they don't fall to their deaths. We also have referees (the SEC and other government regulators/laws/regulations) that can say things like, "hey you, gouging eyes out is unacceptable".

But, referees, have over the past few decades been increasingly bound and gagged (sometimes by themselves), and the people with power to make changes - who are also the ones making most of the money - have been free to rig the game in their favor. Rigging the game is exactly what they are supposed to do as good capitalists. They aren't necessarily interested in the greater good of the company or its workers or the country, they are only interested in the money in their pockets, and so they reduce whatever costs they can to make that happen; reducing compensation paid to labor, eliminating regulations and responsible risk management practices, and reducing taxes.

You don't have to believe that this is true. Reality proves reality. What is, is what was desired by those with the power to make it happen.

Middle Class

The country that we know today was largely built in the aftermath of WWII with the expansion of education, massive infrastructure development, and the rise of the middle-class. Whether it was understood or not people were seen as assets whose value was increased by providing them education, skills, and work opportunities that granted them the money and time to devote to consumption and leisure.

Now, workers are valued for how cheap they are, and we take large groups of people who could be tremendous assets and marginalize or disparage them (like treating immigrants as invaders).

What do we do?

It is simple. And, it is impossible. We do what I showed before:

A massive redistribution of income. Massive to the point of doubling minimum wage or more. Along with an equally massive effort to revamp the education system to not only be internationally competitive but build a workforce with skills relevant for the future.

Can this happen? No way - it isn't in the interest of anyone with the power to do it, and anyone who it would be in the interest of has no power to make it happen. We can not win. I hope you weren't looking for a happy ending.

Notes

1. Data for taxes and spending comes from sites created by Christopher Chantrill. Taxes at http://www.usgovernmentrevenue.com/ and Spending at http://www.usgovernmentspending.com/

2. Michael I. Norton and Dan Ariely. "Building a Better America - One Wealth Quintile at a Time." Forthcoming in Perspectives on Psychological Science. Accessed 23 Jan. 2011. http://www.people.hbs.edu/mnorton/norton%20ariely%20in%20press.pdf

3. Edward N. Wolff. "Recent Trends in Household Wealth in the United States: Rising Debt and the Middle-Class Squeeze—an Update to 2007." Levy Economics Institute of Bard College, 2010. Working Paper No. 589. Accessed 23 Jan. 2011. http://www.levyinstitute.org/pubs/wp_589.pdf